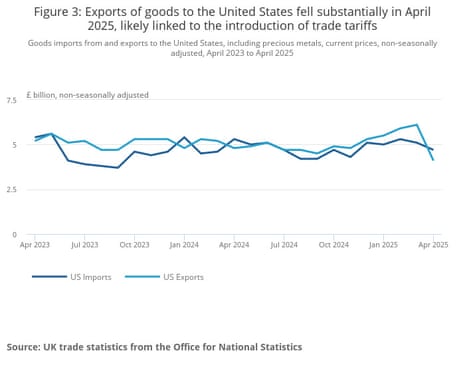

UK trade with the United States plunged in April, as Donald Trump’s announcement of new tariffs hit demand for goods.

Exports of UK goods to the United States fell by £2bn in April, the Office for National Statistics reports, which is another factor why the UK economy shrank so sharply during the month.

This is the largest monthly decrease in trade with the US since records began in January 1997 and follows four months of consecutive increases.

The ONS says this decline is “likely linked to the implementation of tariffs on goods imported to the United States”.

Today’s trade data shows there was a fall in exports of cars, non-ferrous metals and chemical exports to the US in April.

On 2 April, Trump announced that imports from the UK would face a blanket 10% tariff under his new trading system. UK steel producers and carmakers faced higher tariffs, although these should fall under the US-UK trade deal agreed in May.

ONS Director of Economic Statistics Liz McKeown says:

“After increasing for each of the four preceding months, April saw the largest monthly fall on record in goods exports to the United States with decreases seen across most types of goods, following the recent introduction of tariffs.”

Ouch! The dollar has taken another step lower, after new data showed inflation ‘at the factory gate’ was lower than feared.

The US Producer Price Index only rose by 0.1% on a monthly basis in May, below the 0.2% rise expected, indicating that inflationary pressures were lower than feared.

On an annual basis, the PPI index rose by 2.6% in the year to May, the US Bureau of Labor Statistics reported.

The dollar has continued its decline – now down 1% today against a basket of currencies.

UK tax officials have denied that HMRC is “hopelessly outgunned” by the army of lawyers and tax agents in London used by wealthy individuals to minimise the amount of tax they pay, or avoid it altogether.

MPs on the public accounts committee have questioned John-Paul Marks, the new permanent secretary and chief executive of HMRC, and other officials about a recent report from the National Audit Office that found the wealthy could be avoiding more tax than had been thought, with a dramatic fall in the number of penalties being issued to the super-rich.

Lloyd Hatton, a Labour MP, said London was a “world renowned hub for professional services” with an “army of lawyers, of accountants, of promoters of schemes and of tax experts and advisers” and asked how HMRC is tackling this “unique challenge”. He said a lot of people would think HMRC is “hopelessly outgunned and that there is, quite frankly, a very well trained, very knowledgeable part of our professional services sector who go about their life making HMRC’s job pretty impossible”.

Jonathan Athow, director general for customer strategy and tax design at HMRC, replied:

“The NAO report credits the team for the progress that they’ve been through in recent years in more than doubling the yield from our wealthy team, managing to keep the tax gap at around 5% [or £1.9bn], but your point, we want to go further. We want to reduce that tax gap, and my job working with ministers is to make sure the team have got the capacity and capability that they need. They will have more investment and more enablement to do more.”

And Penny Ciniewicz, HMRC’s director of general compliance, said:

“I would just say we’re far from outgunned. We have huge expertise in this space, and we constantly seek to build it, because we’re not complacent. But you can see in the results that the NAO report describes that we are improving both the return on investment and … that we can bring the the most serious cases to successful conclusions in trials.”

Hatton said HMRC was not using the tools it has to impose more penalties, saying the recent stop notices against the tax avoidance specialist Paul Baxendale-Walker was the first time HMRC took action against an individual, not a company.

Marks said: “We’re happy to reassure the committee that we use the power when we think it’s appropriate to do so.” He welcomed the NAO’s report, and said HMRC would implement its recommendations.

The department is recruiting “400 people to tackle the wealthy offshore side” over the next five years, adding to its team of 1,000, which is expected bring in at least £500m in revenue. Marks expects the number of prosecutions to rise in coming years, as HMRC is also investing in artificial intelligence, and is already using predictive analytics and machine learning to ensure the wealthy pay their fair share of tax.

Nesil Caliskan, another Labour MP, said:

“I have constituents living in Barking who are… paying housing charges going to a company owned by individuals living in offshore tax havens, they’re getting ripped off. And… so they really want HMRC to go after individuals who should be paying their fair share of tax.”

Marks said “fairness is right at the heart of our charter.”

And Philippa Madlin, HMRC’s director for wealthy and mid-sized business compliance, said: “We are not complacent and our ambitions are undimmed.”

Newsflash: A key measure of job losses in the US has hit its highest level in almost two years.

The 4-week moving average total of initial jobless claims, which measures how many Americans seek unemployment support, has risen to 240,250.

That’s the highest level for this average since August 26, 2023, and may signal that the US jobs market has weakened, five months into Donald Trump’s second term.

In the last week along, there were 248,000 new initial claims – seen as a proxy for layoffs in the US econony. The previous week’s level was revised up by 1,000 from 247,000 to 248,000.

This morning’s weak growth data and deepening trade imbalance have dampened the outlook for the UK economy, following Tuesday’s disappointing jobs numbers, reports David Morrison, senior market analyst at fintech and financial services provider Trade Nation.

He explains:

The latest UK trade figures showed an historic £2 billion drop in UK goods exports to the US, the steepest monthly decline since 1997 when records began. US imports to the UK also fell by £400 million.

These numbers are an early indication of damage already done by President Trump’s trade war with the rest of the world. A framework for a US-UK trade deal was announced earlier in May, but implementation has stalled.

Key tariffs on steel, aluminium and autos remain in place, contributing to a £4.4 billion widening in the UK’s goods trade deficit over the three months to April. The services surplus also edged lower, down £500 million to £48.5 billion.

With the dollar weakening, the euro has hit its highest level since late 2021.

The single currency has gained more than a cent today, hitting $1.16 for the first time since November 2021.

Other currencies are also climbing against the dollar; the Swiss franc rose 0.8% to 0.8138 versus the greenback, its highest level since April 22, while Japan’s yen climbed 0.6% to 143.70.

The pound has gained half a cent, to $1.359.

Back in the financial markets, the US dollar has dropped to a three-year low against a basket of currencies.

The dollar index has lost 0.7% of its value today, hitting its lowest level since March 2022.

The decline comes after Donald Trump yesterday threatened to set unilateral tariff rates on US trading partners, a blow to hopes of a negotiated end to the trade war.

Vasileios Gkionakis, senior economist and strategist at Aviva Investors, fears that the “risk premia” on the US dollar is rising, as investors fret about persistent fiscal deficits, weakening foreign demand for government debt, and institutional uncertainty.

Gkionakis explains:

The US has been enjoying a significant privilege for decades, with higher issuance being matched by foreign investors’ appetite for US paper.

This is now shifting, with the US likely to run large fiscal deficits for years without a commensurate fiscal impulse – and against a backdrop of an extended net international investment position. All this is agitating markets who in order to lend to the US would require a combination of higher yields and a weaker exchange rate.

In other words, the shift away from US exceptionalism is driving the US risk premium higher and is weighing on the value of the dollar. Indeed, our estimate of the US10Y risk premium has correlated rather well with the dollar movements since April.

Economic warning signs are flashing over the UK economy, warns Kate Nicholls, chief executive of UKHospitality, following April’s 0.3% drop in GDP.

Nicholls blames the cost increases which hit businesses in April, including higher naional insurance contributions (which were also blamed for a rise in unemployment earlier this week).

She says:

“GDP figures can be volatile but an immediate shrinking of the economy and more than 100,000 jobs lost in just a month shows that the huge increase to employer NICs is putting the brakes on growth.

Hospitality is a resilient sector and businesses are doing all they can to trade their way out of these challenges, but it has the potential to be the engine for growth if it is properly backed.

“The economy only grows when hospitality is strong. The Government needs to take these warning signs seriously and urgently review and reverse the changes to NICs, while bringing forward clear plans to empower hospitality and the high street.

In Britain’s agriculture sector, the National Farmers’ Union has accused Defra’s Steve Reed of “misleading” spending review claims over the farming budget.

The department has claimed payments for the nature-friendly farming programme, called the Environment Land Management Schemes, will “skyrocket” from £800m in 2023/24 to £2bn in 2028/29. This, on the face of it, looks like a large funding increase and has been reported by some as such.

However, it doesn’t look to be. This is because after the UK left the EU, farmers were promised that their subsidies would be the same as they were under the EU, and were promised a figure of £2.4bn a year.

The Tory government at the time decided that rather than being paid per acre, farmers should be paid for improving nature so devised the ELMS schemes, but while these got up and running the acreage payments known as Basic Payments Schemes (BPS) were kept. These would be cut each year as the ELMS increased and are due to be phased out entirely by 2028.

So, farmers currently get the £2.4bn a year in two streams – the ELMS and the BPS – as well as a smaller amount of money in grants for things like robotics trials.

By 2028/29 they will not be paid BPS so will only get ELMS and this will have a value of £2bn. There may be some other grants available to top this up, but this has not been confirmed.

In reality, the government has promised an average of £2.3bn a year up to 2028/29 for the farming budget, which is a £100m a year cut, and by the end of the spending period it looks like the budget shrinks to not much more than £2bn.

NFU senior economist Sanjay Dhanda has said Defra has been “misleading” in its claims.

He said:

“A key pillar of Defra’s budget is the continued investment in ELMs, with funding set to rise to £2 billion by 2028/29 compared to the £1.8 billion earmarked in the Autumn 2024 budget. While the government has framed this as a significant uplift from the £800 million spent in 2023/24, this comparison is misleading as ELMs was not fully operational at that point, and de-linked payments (BPS) absorbed a large share of funding.

“The actual increase is a modest £200 million over four years – barely sufficient to keep pace with inflation, let alone scale up delivery.”

The tumble in exports to the US in April helped to widen the UK’s trade deficit.

In April alone, UK goods exports fell by £2.7bn – of which £2bn was the decline in sales to the US, plus a £600m drop in exports to the EU.

Overall, the UK’s trade in goods deficit widened by £4.4bn to £60.0bn in the February-April quarter.

That more than surpassed the services sector’s surplus, which fell by £500m to £48.5bn over the quarter.

In the travel sector, disruptive Ryanair passengers whose behaviour results in them being removed from the plane will be fined £500.

Europe’s biggest airline said this would be the “minimum” punishment and that it would continue to pursue ejected passengers for civil damages.

This morning’s disappointing UK growth, and trade, data hasn’t caused a panic in the City.

The FTSE 100 share index has dipped by just 9 points, or 0.1%, to 8855 points, having ended Wednesday near its closing high.

Other European markets are having a rather worse morning; Germany’s DAX index has dropped by 1.35%, while France’s CAC is down 1%.

Trade war fears are, again, rippling across trading floors, even though the US and China patched up their truce yesterday.

President Donald Trump has alarmed investors by revealing yesterday tht he plans to send letters to trading partners in the next couple of weeks setting unilateral tariff rates

Trump told reporters Wednesday at the John F. Kennedy Center for the Performing Arts in Washington:

“We’re going to be sending letters out in about a week and a half, two weeks, to countries, telling them what the deal is.

“At a certain point, we’re just going to send letters out. And I think you understand that, saying this is the deal, you can take it or leave it.”.

That has undermined hopes that the US might agree trading deals with its partners before the 90-day pause announced by the US president in April expired.

Analysts at Investec reckon April was “payback time” for the UK economy, as shown by the 0,3% fall in GDP.

They point out that the fall in GDP was due to two factors.

-

The first is that frontrunning took place in the UK housing market, where homebuyers had brought forward house purchases to beat the 1 April deadline when stamp duty reverted to being imposed at lower thresholds.

This had boosted residential transactions pre-April and especially in March (+61.6%), only to then be followed by a large slump in April (-63.5%). Such swings in transaction around stamp duty changes are by no means unusual in the UK housing market: there were precedents around, for example, the end of the pandemic ‘stamp duty holiday’. This affected conveyancing solicitors as well as real estate agencies’ output negatively in April. Indeed, legal activities saw their output plunge by 10.2% on the month, having experienced a 4.1% jump in March, and ‘real estate activities on a fee or contract basis’ witnessed a 6.5% drop after a 1.8% increase in March. These two swings together sliced off 0.19%pts from monthly GDP in April, as per our calculations, and so therefore explain the bulk of its fall.

-

The second, of course, is that ahead of ‘Liberation Day’, the timing of which the US administration had pre-announced in February, companies had brought forward production and exports to the US market that would otherwise have taken place later on.

A fall in production in April is therefore, to some extent, payback. An example for this is likely to be the car industry: the output of motor vehicles, trailers and semi-trailers fell by 9.5% in April, having jumped by 7.4% in March. This subtracted a further 0.07%pts from monthly GDP, we calculate. Whereas this may not have been solely due to front-running to the US – the Society of Motor Manufacturers and Traders also reported model changeovers to have contributed, for instance – this seems likely to be have been an important factor.

The sharper-than-forecast slide in UK GDP in April is a “headache” for chancellor Rachel Reeves, reports ING’s Developed Markets Economist, James Smith.

Smith says April was a disappointing month for the UK economy, partly because manufacturing surged earlier in the year as customers tried to avoid Donald Trump’s tariffs, leading to a fallback once they were announced.

He adds:

Yesterday’s spending review – an exercise which divvies out budgets across government departments – carried few surprises. Yet it was a reminder that there’s not enough money to go around and that the overall spending pot for the next few fiscal years will likely end up rising more quickly.

“We think the Office for Budget Responsibility is highly likely to revise down its 2026 growth forecast at the Autumn Budget later this year, which alone would wipe out half of the Treasury’s slim fiscal headroom. Further downgrades to trend productivity growth projections, as well as net migration, mean the Chancellor is likely in the red, before even considering the mounting pressures on the public purse. The overall shortfall may amount to at least £20bn, and that means tax rises are highly likely.”